In today’s business world, the path to a sustainable and competitive strategy often mirrors a calculated form of gambling. The primary difference? Rather than betting recklessly, savvy business leaders aim to minimize risk and maximize success probabilities. This balanced approach is increasingly essential for both startups and SMEs as they contend with larger, more established corporations.

Strategic Thinking: The Balance Between Safety and Growth

For large corporations, strategic planning has traditionally meant playing it safe. Governing boards and executives tend to favor stability, risk aversion, and gradual innovation. However, a significant shift is occurring in the business landscape, requiring companies to rethink their tolerance for risk. As new startups emerge with rapid innovation cycles, larger players risk falling behind if they adhere too strictly to conservative strategies.

How Big Companies Respond to the “Garage Startups” Threat

Historically, corporate giants rarely worried about small-scale innovators. The idea of a couple of entrepreneurs in a garage outpacing an established corporation seemed improbable. But the startup ecosystem has matured, and capital flows more freely than ever. The threat isn’t merely the single garage startup but rather hundreds, even thousands, of them. These small but agile innovators may not succeed immediately, yet their cumulative impact can drive disruption across entire industries.

One illustrative example is Google’s early disruption of the advertising industry, transforming a long-established market in less than a decade. For big corporations, the key to mitigating this threat is not merely defensive but adaptive.

The Case for Disruptive Subsidiaries

A strategy that has gained traction in recent years involves creating “disruptive subsidiaries.” These departments or specialized units operate independently, focusing on rapid innovation without the constraints typically imposed on core business divisions. Not only does this allow the main corporation to maintain its market position, but it also prepares the company for a pivot when new opportunities arise.

While this approach can be effective, persuading boards and senior executives to back disruptive initiatives can be challenging. Many companies, such as Kodak and Xerox, have famously hesitated to embrace future trends, ultimately finding themselves overshadowed by new competitors.

Exploring Strategic Alternatives: From Skunkworks to Acquisition

Establishing a disruptive subsidiary is not the only option for embracing innovation. For instance, some companies adopt the “skunkworks” approach, forming smaller, more flexible teams that work outside of traditional structures. This model provides freedom to explore new ideas without disrupting the company’s primary operations.

An alternative strategy, particularly popular in technology-heavy fields like self-driving vehicles, involves acquisition. In recent years, major automakers have taken strategic steps to secure a position in the autonomous vehicle sector:

- General Motors acquired Cruise Automation in 2016, setting the stage for rapid advancements in autonomous driving capabilities.

- Ford acquired Argo AI in 2021, gaining a team already experienced in self-driving technology.

- Toyota bought Lyft’s self-driving unit in 2022, obtaining both technology and a network to expedite their self-driving ambitions.

These acquisitions reveal a tactical advantage: rather than developing a technology from scratch, larger companies can bring in focused, experienced teams capable of delivering quick results. For smaller companies, this trend indicates that demonstrating unique technological advancements could lead to acquisition by larger, resource-rich entities.

Understanding Organizational Resistance to Innovation

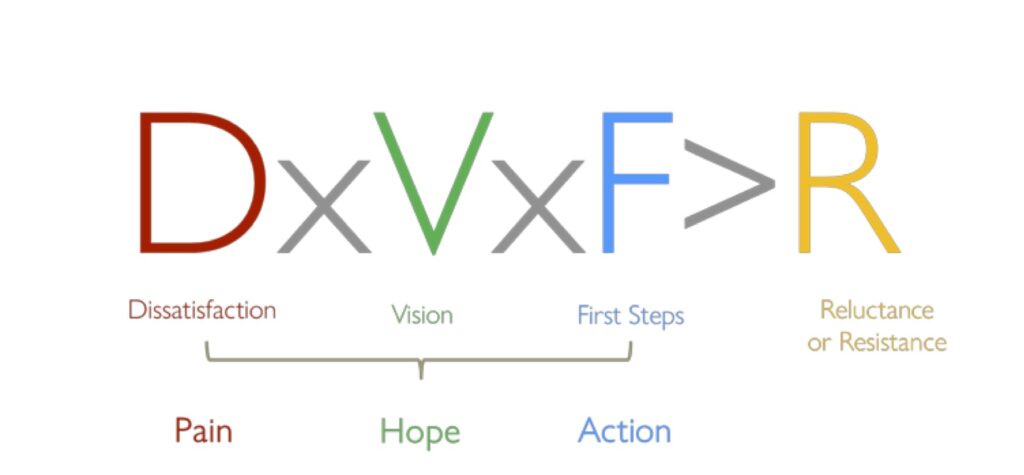

The journey toward embracing innovative changes often encounters resistance within established corporations. This resistance is primarily due to the fear of deviating from a stable revenue model and the unknowns of a significant shift in strategy. Board members and CEOs may hesitate to take on what feels like a 50-50 risk, especially when stability appears more predictable. Yet, as industries evolve, it becomes increasingly crucial for organizations to recognize and mitigate this resistance.

Adapting to Win the Long Game

The tension between large corporations and startups will only intensify. For companies navigating this dynamic, the choice is clear: adapt or risk obsolescence. Strategies like disruptive subsidiaries, acquisitions, and internal innovation initiatives provide diverse paths toward growth. The ability to embrace these strategies is a defining characteristic of companies that thrive in today’s rapidly evolving business landscape.

In the next article, we will continue to explore the nuanced psychology behind risk aversion, and additional strategies that can help both startups and SMEs gain a competitive advantage.

Written by Shadi Ashour

Business Development consultant